1. INTRODUCTION

One of the most widely discussed aspects regarding the English Agricultural

Revolution has been quantifying the magnitude of the agricultural product and

GDP per capita. The Agrarian Reform (1536) and Social Revolutions (1640 and

1688) disrupted one of the most useful sources used as a proxy for crop

production in continental Europe in pre-capitalist times: tithes (Kain & Prince, 2006). This lack of data has led to estimations being made from

indirect methods and other sources. From a demand-side approach, agricultural

production has been calculated on the basis of consumption per head,

population, prices and elasticities. From a supply-side approach, on the other

hand, the sources have been a growing set of non-randomly selected

site-specific probate inventories and farm accounts. This methodological

diversity has produced widely varying estimates due to the differing temporal

and spatial features and sources used in each case. For instance, Morgan Kelly

and Cormac Ó Gráda (2013) have called for an upward adjustment of the recent agricultural

production estimated by Stephen Broadberry, Alexander Klein, Mark Overton and

Bas van Leeuwen (2015). There is also an ongoing debate over the dating of the

English Agricultural Revolution, raised by Mark Overton (1996a) and Robert C.

Allen (1991, 2008, 2009). Another open question is whether waves in

agricultural output and productivity might have been responsible for the slow

progress of English economic growth between 1760 and 1815, and for its later

acceleration. To help determine the answers to these questions, Robert Allen

has called for new methods to be developed that allow a better inference of

changes in production and yields (Allen, 1999: 209-211).

In partial response to Allen’s request, the aim of this paper is to estimate an annual series of wheat output

in England between 1645 and 1761. A new method is presented based on Davenant’s Law (1699). Charles Davenant was a contemporary author from that intriguing

period and the first to propose estimating the inverse variations of wheat

harvests from the variations of their prices. He did this using data previously

collected by Gregory King. The usefulness and accuracy of this method has been

highlighted by historians such as Edward Anthony Wrigley (1987) and economists

such as Anthony M. Endres (1987) and Jean-Pascal Simonin (1996). The method is

also currently being used to estimate production from prices when facing

unreliable statistical output data (Nielsen, Smith & Guillén, 2012). We will use it for the same purpose, adding other assumptions, i.e. to estimate a final aggregate gross and net production of wheat –meaning gross output minus seeds, animal feeding and losses– from a demand-side approach, to then compare the outcome with the supply data

assembled by other historians who have considered yields, population growth and

long-term income growth.

Notwithstanding the importance of wheat it is worth stressing other grains, such

as barley, rye and oats, as well as pulses, turnips and clover, potatoes and

livestock. However, as Robert Allen stated, during the transition from

subsistence to market agriculture and urban development wheat dominates the history of crop yields, and the history of wheat shows the

importance of the pre-1750 agricultural revolution (Allen, 1999: 225).

This paper is structured as follows. The first section summarizes the current

debates in agricultural historiography. The second explains the methodology

used to build the new series. The third assesses the results obtained comparing

them with current estimates, and justifies their accuracy. And the fourth

concludes.

2. THE PROBLEM WITH ASSESSING THE ECONOMIC PERFORMANCE OF ENGLISH AGRICULTURE

PRIOR TO 1884

There are no statistical data on the annual physical wheat production in Britain

prior to 1884 (Mitchell, 1988). Neither can we count on any proxy such as

tithes, traditionally used as sources in continental Europe. Thus, over the

last thirty years economic and agricultural historians have had to use other

indicators to assess the performance of English agriculture: total physical

output, yields, agricultural production, consumption and elasticities. As can

be seen in Table 1, physical output estimates are scarce and never annual. One

of the earliest was contributed by Phyllis Deane and W. A. Cole (1967: 62-8)

and showed a rise in wheat production during the 18th century from 29 to 50 million bushels (73%), substantially larger than the

growth in other grains (43%). Gross production can be calculated using the

acreage estimates and Allen’s yields (2005: 28, 32) put forward for the period 1300 to 1850, and this

highlights a dramatic increase in production between 1800 and 1850.

Based on some assumptions regarding the consumption of bread and flour by

labourers, Robert Allen also presented an estimate to support his idea that the

volume of wheat demand was bigger than that put forward by Gregory Clark

(2007), according to which wheat demand would have gradually risen from 40

million bushels in 1770 to 170 or more in 1850, with a rapid increase from 1820

onwards. Allen multiplies the share of bread and flour in the average wages by

the employed population (manual labour). He obtains the total income spent on

bread and flour, which he divides by their respective prices, deducting their

volume. Applying a 2:1 relationship between bread and flour, he calculates the

total wheat demanded in bushels. To do this, he supposes an income elasticity

of bread and flour demand equal to zero at the upper average income levels of

manual labourers. The latest estimates have been presented in Broadberry et al. (2015), with decennial averages of net physical output and cultivated area

taken from a Manorial Accounts Database, a Probate Inventories Database and a

Modern Farm Accounts Database following a supply-side approach. All of these

estimates are summarized in Table 1.

Table 1

Physical output and demand of wheat in millions of bushels, according to different authors, 1650-1884

| Years | Estimate | Type of estimate | Author |

| 1650-59 | 27.01 | Net output | Broadberry et al. (2015) |

| 1700-09 | 27.94 | Net output | Broadberry et al. (2015) |

| 1700 | 30.00 | Gross output | Deane and Cole (1967) |

| 1700 | 26.60 | Gross output | Allen (2005) |

| 1750-59 | 31.48 | Net output | Broadberry et al. (2015) |

| 1750 | 42.00 | Gross output | Allen (2005) |

| 1770 | 40.00 | Demand | Allen (2007) |

| 1800-09 | 46.32 | Net output | Broadberry et al. (2015) |

| 1800 | 50.00 | Gross output | Deane and Cole (1967) |

| 1800 | 50.00 | Demand | Allen (2005) |

| 1850-59 | 73.69 | Net output | Broadberry et al. (2015) |

| 1850 | 100.80 | Gross output | Allen (2005) |

| 1850 | 170.00 | Demand | Allen (2007) |

| 1860-69 | 86.07 | Net output | Broadberry et al.(2015) |

| 1884 | 80.20 | Gross output | British Statistics (1988) |

Source: our own calculation. Calculation from the references given in the table.

A second and much more frequent approach is that related to land productivity

(yields), measured in bushels per acre. Although we can find abundant

information on the Middle Ages, and again in the 19th century, estimates on the early modern era are scarce. This has led researchers

to use intermediate methods, with estimates being elaborated from site-specific

primary sources, mainly local probate inventories (Overton, 1979, 1991, 1996a,

1996b; Allen, 1988, 1989, 1991, 1999; Glennie, 1991; Turner, 1982, 1986;

Theobald, 2002; Yelling, 1970, 1973) and farm accounts (Turner, Becket & Afton, 2001). For the second half of the 18th century and the beginning of the 19th century, there is the well-known work by Arthur Young (see John, 1986). There

are also some public statistics, such as the Harvest Inquiries of 1794, 1795

and 1800, Crop Returns in 1801 (Turner, 1982), and the Board of Agriculture

Surveys in 1816 (see John, 1986). The works of James Caird in 1852, Mark Lane

Express in 1860 and 1861 (John, 1986), or those by John B. Lawes and Joseph H.

Gilbert (1893) regarding the results of the Rothampsted experiments between

1852 and 1884. A summary of all these contributions can be found in a chapter

on the wheat question published by Turner, Beckett and Afton (2001: 116-49).

The figures proposed by M. J. R. Healy and Eric L. Jones (1962) are also

available, based on market studies of Liverpool grain merchants, and from data

published by B. A. Holderness (1989), which reported 16 Net bu/acre in 1750,

19.5 in 1800, 20.5 in 1810, and 26 in 1850.

Liam Brunt (2004, 2015) used another different approach from the supply-side

perspective. This author analysed the production of wheat and its yields. To

control for variability, he used climatic variables (temperatures and

rainfall), which he related to output data registered by the cereal traders of

Liverpool between 1815 and 1859 by means of a regression model (Healy & Jones, 1962). He then predicted crop movements backwards before introducing

technological variables to establish the trend.

All of these data have created a difficult puzzle to fit together. Some basic

facts do seem quite clear, however. Agricultural output per head increased

between 1700 and 1760 (Crafts, 1980). Yet, there is a long debate on what

happened before 1700 and after 1760. Mark Overton (1996a) argued that it was

between 1750 and 1850 that the Agricultural Revolution took place, whereas

Allen pointed out that output grew slowly, and yields fell during the second

half of the 18th century. The first wave of innovations (clover, turnips, new Leicester sheep,

convertible husbandry) did not seem to contribute much to economic growth from

1760 onwards, and Nicholas Crafts even talked about a Malthusian shadow threatening England at the end of the 18th century (Crafts, 1980). It was not until the first half of the 19th century that agricultural output started to rise significantly. Assuming this

would help to explain the slow advance of the first stage of the Industrial

Revolution and the faster next stage. Allen also suggested a three-stage

general chronology: from 1520 to 1739, from 1740 to 1800, and from 1800

onwards. During the first stage, there would have been significant agricultural

growth, also pointed out by Jones (1965) and Kerridge (1967) and other authors.

During the second stage, output only increased 10% (and yields also began to

decline), whereas from 1800 to 1850, agricultural production grew by 65%

(Allen, 1999: 210-25).

According to Gregory Clark (2002: 16-25), population growth during the

Industrial Revolution was largely supported by food imports. Rather than a

productive revolution, there would have been a reorientation of agriculture

towards human feeding. Before 1869, improvements in land yields would have been

much more relevant than in labour productivity. In this author’s opinion, it was a long period of modest but constant advance in crop yields

(1600-1750). After that period, a 50-year pause would have followed, when both

yields and labour productivity decreased. And then, after 1800, land and labour

productivities would start to grow slowly but steadily.

Finally, under another perspective related to consumption, food demand and

elasticities, E. J. T. Collins (1975) claimed that it was not until at least

1745 that the increase of income made wheat the most consumed cereal by the

English population. During the 17th and 18th centuries rye bread, and that made by mixing other cereals, were basic foods. Maslin (wheat and rye bread) and muncorn (barley and oat bread) predominated in the Lowlands. Barley, rye, oat, beans and

pulses marked the prevailing consumption pattern. High substitution elasticity

would explain why England avoided famine (Appleby, 1979; Hoyle, 2013). Even

during the Tudor period, and that of the first Stuarts, Malthusian pressure

reduced wheat consumption. Something similar was claimed by chroniclers of the

time. Gregory King described wheat consumption as being in the minority at the

end of the 17th century. According to Tooke and Newmarch (1838), the increase of wheat bread

consumption was slow. In south-west England, the working classes (including

agricultural labourers and small farmers) consumed barley. In 1795 less than

45% ate wheat bread, while barley still prevailed in the peninsular counties

(55%). In Wales, staple food consisted of barley and oats, whereas in the

Midlands the consumption pattern was more diversified (Collins, 1975: 98-9).

Christian Petersen (1995) dated the beginning of the golden age of wheat bread between 1770 and 1870, not earlier. We know that between 1656

and 1704 wheat became more expensive than rye (its relative price increasing

from 1.23 to 1.89). Although wheat prices decreased later, it was still more

expensive than rye in 1739 (1.43), and from 1750 onwards its exchange rate

worsened again according to our own calculation using Gregory Clark’s prices (2004, 2005, 2007). Using the output estimates of Broadberry et al. (2015: 98, 112), we find that in 1650 wheat would have constituted 38.4% of

grains (27.01 million of bushels on average), and 36.7% in 1750 (31.48 million

bushels on average).

Another sign of increased wheat demand is international trade. It was not until

the 1760s that Great Britain became a wheat importer (Ormrod, 1985). Government

policies must also have had an influence on this fact: several regulations (Assize of Wheat, Bounty Acts) kept wheat prices high thereby affecting domestic consumption (even though it

was decreasing in the long run), a fact harshly criticized by Adam Smith in his

Wealth of Nations (1776). From the second half of the 17th century, export subsidies began to be applied, such as those implemented in

1663 and 1689, although they do seem to have been more effective in the first

half of the 18th century. They were cancelled in periods of scarcity, as in the late nineties of

the 17th century (Comber, 1808; Hipkin, 2012). Some econometric studies also confirm the

influence of Corn Bounties on wheat supply (Tello et al., 2017). At the same time, however, it seems that wheat was the most integrated

cereal in the different English counties as early as the 1690s (Chartres, 1985,

1995) –although this remains a controversial issue.

In summary, it would seem that cereal consumption was diverse in Britain during

the 18th century and wheat did not start to stand out until at least after 1760.

Consequently, it is acceptable to assume that the slow income per head rise was

not initially a significant factor in wheat demand. Whereas farm management in

relation to soil fertility, land yields and labour productivity, together with

weather impacts and expectations, determined the evolution of supply,

population growth was the main driver of wheat demand. This fact suggests an

inverted U-shaped wheat income elasticity (εi) over time. In a first phase, it would be null or very low. As wheat bread –and other wheat products– increasingly started to be consumed and replaced other types of bread to become

a basic product, εi increased. It only fell again when the standards of living improved,

consumption diversified, people’s preferences changed, and basic needs were better met at the end of the 19th century. We know that elasticities are not fixed over time. As recent research

shows, while εi is currently low in both countries where wheat is secondary and well-developed

countries, it is high in under-developed ones (Abler, 2010).

It has also been observed that price elasticity tends to fall when income

elasticity does (Abler, 2010: 21). This trend has been confirmed by Campbell

and Ó Gráda’s work (2011), which showed that the price elasticity of wheat demand fell in

the very long term. These authors analysed Robert Fogel’s (2004) and Gunnar Persson’s (1999) divergent positions on the issue. Fogel assumed a low price elasticity

of demand throughout the Modern Age in England (-0.183). He also provided

complementary reasons for product variation such as income distributed

unequally and government passivity (Campbell & O’Grada, 2011: 875). Conversely, Gunnar Persson (1999) and Rafael Barquín (2005) proposed higher elasticities (-0.6 and -0.6/-0.8, respectively). This

meant a significantly greater threat of famine, mortality outbreaks and dearth

compared to Fogel’s assumption. In light of these two positions, Campbell and Ó Gráda (2011) adopted a more dynamic vision: if the price elasticity of English

grains fell between half and one third in the long term, harvest variability

would have substantially decreased, leading to a new period of economic,

political and biological progress.

Indeed, most of these pieces of research on agricultural price elasticities may

be right in their own terms. The problem lies in the different sources and

methods applied to different historical times, which makes it difficult to

reach conclusive results. A great deal of these studies have been carried out

on food products as a general category rather than wheat. It can be assumed

that the absolute value of wheat income elasticity (εi) was much lower than that of other food items, such as meat. Nicholas F. R.

Crafts (1980) quotes three old works that use cross-sectional data. The first,

published by D. Davies (1795) estimated a food εi near to 1. The second, by F. M. Eden (1797), obtained similar income elasticity

for a group of poor agricultural labourers. And the third, conducted by W.

Neild (1841) for industrial workers in Lancashire between 1836 and 1841,

established an εi of 0.853. Crafts ends up calculating an εi of 0.74 for the period from 1820 to 1840, and applying a similar value (0.7) to

the period 1700-60 for food in general, though not for wheat (Crafts, 1980:

162). Clark (2002: 29) used similar values in his agricultural demand equation,

with an εi of 0.6. In Clark, Cummings and Smith (2010), a value of 0.6 is still found for

1860. However, Clark considered the increase in income per head to be small

between 1760-69 and 1860-69. Therefore, once more it is assumed that the role

played by income elasticity of food demand would have been limited. Following

Crafts and Clark, Allen (1999: 213) also suggested a food price elasticity of

0.6.

According to Robert Allen, Clark assumed income elasticity to be below 0.6

because his budget studies did not include high incomes. For the same reason,

Crafts estimated an income elasticity for all food products rated at 0.5. That

meant a small crossed elasticity of 0.1, and a price elasticity of -0.6. Some

years later, Allen (2005) dealt with this subject again, obtaining an income

elasticity of 0.5 in 1300, of 1 in 1500 and of 0.5 after 1500. Later, in 2007,

he estimated wheat output from consumption per head by assuming demand income

elasticity for bread and flour of 0 at those levels above the average income.

On the other hand, applying Craft’s food εi for wheat (0.5), Barquín (2005: 244-50) concluded that wheat price elasticity in England must have

ranged between -0.6 and -0.8, questioning Fogel (-0.18) and King-Davenant’s Law (-0.4), and agreeing with Parenti (1942) and Persson (1999). By way of

conclusion, studies conducted on food price elasticity εp range from -0.18 to -0.80, and lately -0.6< εp < -0.8. For income elasticity εi, the range is between 0 and 1, and more precisely between 0.5 and 0.7. Campbell

and Ó Gráda estimates with the available data provided by Turner, Becket and Afton (1997)

would be a demand price elasticity of -0.73 (using net yields) in the period

1268-1480, or of -0.57/-0.55 (using gross yields), that would have been lowered

to some -0.23/-0.35 from 1750 to 1850 (using gross wheat yields).

3. METHODOLOGY USED TO ESTIMATE A YEARLY SERIES OF PHYSICAL WHEAT PRODUCTION IN

ENGLAND (1640-1761)

If we wish to obtain an annual series of physical wheat output on the basis of

probate inventories, there is little we can do. Doing the same thing based on

consumption (like Clark or Allen), the results are so general that they do not

allow much advance either. But by integrating the two approaches, the outcome

is better than the sum of the parts. This is the holistic principle supported

in this article following Allen’s advice: since all methods are indirect (even the one created by Mark Overton

relying on probate inventories), it is inevitable that we start from one or

several theoretical assumptions. This means that historians must examine all

these approaches without underestimating any position, testing all of them all

equally against the scarce empirical evidence available (Allen, 1999: 211).

Accordingly, we propose the following estimation method. First, deduce the

yearly variation of harvests from the variation of prices. To do this, we need

a mathematical expression that relates prices and quantities. Taking the price

and physical quantity for the year 1700 (a year of average production), and

knowing the prices of other years, we can calculate the physical quantities of

all years of the period with an equation based on a price elasticity

assumption. We do not have any prior econometric equation for the period

1640-1761. For a standard regression model, we need the two variables of price

and quantity, but we do not have the latter. We do, however, have the

King-Davenant-Jevons-Bouniatian equation (Davenant, 1771[1699]; Endres, 1987;

Wrigley, 1987; Simonin, 1996). This expression was developed from observations

made in the 17th century. There is no written proof that it was developed as such by Gregory

King. For this reason, it is believed that it was some kind of “law” discovered by Charles Davenant, who was the first to quote it. According to

this “law”, the progressive reductions of one tenth of production generated successive

price rises in the sequence of 1.3, 1.8, 2.6, 3.8, and 5.5. Compared to a

normal harvest, one at 90% would increase the equilibrium price of wheat 130%.

A harvest at 80% would increase the price 180%. This supposed “law” –or rather, empirical regularity corresponding to a given historical context– was formalized by Stanley Jevons through an algebraic expression, and later

improved by Mentor Bouniatian as follows:

y = 0.757 / (x - 0.13)2 (1)

Calculated by means of Davenant’s Law, price elasticity is -0.403, although Barquín (2005: 244-50) corrected this value downward to 0.360. Generally speaking,

Davenant’s Law has been acknowledged by economic historians for a long time, from Tooke

and Newmarch (1838) to Thorold Rogers (1877) and Bernard H. Slicher van Bath

(1963). For example, Mentor Bouniatian proved its validity for American corn

price elasticity between 1866-91, and Prussian rye around the middle of the 19th century. Anthony Wrigley accepted its prestige, although it was not clear for

him whether Davenant talked about net or gross product, or whether it was also

applicable to other places and times (Wrigley, 1987; Nielsen, Smit & Guillén, 2012). There are other authors who have disregarded the price elasticity

resulting from Davenant’s Law, either considering it to be too low or merely a speculative

generalization with no real basis (Barquín, 2005; Persson, 1999; Parenti, 1942). However, Campbell and Ó Gráda’s (2011) research on English wheat harvest variability suggests a decrease in

price elasticity in the very long term from a value of -0.57 for 1268-1480 to

-0.23 for 1750-1850. Surprisingly, Davenant’s value is an average of both values that can only be applied to an intermediate

stage. Another recent study on 19th century Saxony confirms the validity of this (Uebele, Grünebaum & Kopsidis, 2013).

Furthermore, it seems that this “law” also formed part of English traders’ practical knowledge. According to William Petty, a good trader had to possess

certain abilities: he had to be good at arithmetic and accounting, intelligent,

a connoisseur of trading practices and the weights used at every commercial

site, and of all the currencies, interest rates and exchange rates. He needed

to know about the seasons in which agricultural raw materials were sowed in

different places, the shipping points and routes, the relationship between

volumes and transaction prices, transport costs, customs duties and wages

(1927: 192). Charles Davenant (1656-1714) was himself one of these well

informed English traders and extremely knowledgeable about all such 17th-century practices and rules. Taking advantage of his privileged high-ranking

position, he published in 1699 An Essay upon the Probable Methods of Making a People Gainers in the Balance of

Trade (Davenant, 1771 [1699]). Interestingly, this is a work about policy to be

applied to fight the fluctuation of harvests, about the prices of grain, and

how to profit from trade. Davenant calculated that in a period of good

harvests, England could count on five months of grain stock. By estimating the

price rise resulting from bad harvests and the observation of Dutch barns

management, he suggested that England should take similar stock measures to

avoid famine for the poor (Hutchison, 1988: 51-2).

We therefore assume the implicit price elasticity of Davenant’s “law” to have been a knowledgeable observation of the time, a very good historical

source in itself. The method deriving from this assumption is as follows. In

equation (1), y is an index number of the wheat price. Assuming that Clark’s price of 1700 is equals to 1 (y = 1), we calculate the values for the other years: x represents the proportion (or quotient) between the actual quantity (the

numerator) and the “usual” average quantity (the denominator). We assume that this quotient is equal to 1

for 1700, that is, the numerator and the denominator are the same (real

quantity = usual quantity), which means considering this an average harvest of

a “usual” year according to Broadberry et al. (2015) and Deane and Cole (1967) (see also Table 8 below). Then, for the other

years the numerator (the real quantity of the market) is the unknown variable

whose value is to be determined.

It should be noted that in this way we obtain a series in millions of bushels

according to the implicit price elasticity of Davenant’s Law, but without revealing a trend. We have inferred variations of quantities

from variations of prices without considering that both demand (the population

to be fed) and supply (wheat acreage and produce) also changed. Ignoring this

would mean assuming a completely unrealistic stationary state where only

harvests and prices changed yearly. Therefore, we have incorporated a

population index to obtain a second series, which registers short-term movements (based on King-Davenant’s Law) plus the trend derived from population change. The following step is to

add another trend factor, income variation, together with an average factor (n) greater than 0, which attenuates the effect of income on wheat demand (e.g. 0.4), providing us with a third series. The final output in the second and third series depends on the figure that we

take as “usual” in 1700 (the denominator). If the output is net, the calculated series is for

net production. If the output is gross, the calculated series is for gross

production.

Finally, we estimate market demand. If the series obtained shows a net output,

we have the supply of domestic produced wheat. If we deduct the net foreign

balance (the difference between imports and exports), we obtain the demand for

wheat. If the series obtained is for gross output, the part devoted to seeds

and other uses must be deducted from the resulting series and the foreign

balance added (everything depending on the starting value as the “usual” average quantity).

By means of this method we obtain four output series: in the first one (series

I), we take the physical net output provided by Broadberry et al. (2015: 398) to be the “usual” quantity in 1700 and we add demographic pressure using the estimates provided

by Wrigley. Series II incorporates income growth accumulated in the long term,

calculated using the real GDP index taken from Broadberry et al. (2015) and corrected with a factor of 0.4. For series III, we take the value

provided by Deane and Cole in 1700 (1967) as an alternative “usual” quantity. Unlike the former series, this value is of gross output and we apply

the same former population index to it. As a result, it also shows a gross

series of wheat production. The fourth series (IV) is obtained by including the

same income growth as in series III. To infer total demand in the English

market, when necessary, we add the net foreign balance to the net series of

each of the series (Mitchell, 1988; Ormrod, 1985).

The aim of estimating four series is to verify two issues. Firstly, whether

using net data or gross data is more accurate as a starting point. Secondly, to

consider whether it is better to add only population growth as a trend factor,

or to add national income as well. We use a physical datum of 1700 as the

starting point because it was a regular or “usual” average year. The annual average income from the real GDP is one of the few we

have and, according to Broadberry et al. (2015), it was obtained independently from the other values (Clark’s prices, and Wrigley’s population estimated from parish records). We must be aware that GDP and

population are statistically related. The series of GDP and wheat prices must

also be correlated, given that agricultural GDP forms part of total GDP, and

wheat was in turn an important component of agricultural output. Otherwise we

would suspect that the series are not derived correctly. Upon performing the

independence test, all of the above applies, a correlation coefficient of -0.36

between wheat prices and real GDP, of 0.58 between population and real GDP, and

-0.0428 between wheat prices and population, with a critical value at 5% to two

tails equal to 0.20 for n = 91 (1650-1740).

The second part of the method used compares the four series obtained, to the

available database of land yields, labour productivities and prices at a

site-specific micro-level (probate inventories and farm accounts), as well as

with other output estimations and total demand accounts at a macro-level. For

the net series I and II we carried out an estimation of the gross yield per

acre, dividing these series by the surface area of land cultivated with wheat –2 million acres if we follow Broadberry et al. (2015) for 1650, 1700, 1750 or Allen for 1750— and adding 2.5 bu/acre as the part devoted to seeds and other uses. For the

gross series III and IV, the yield is calculated directly by dividing them by 2

million acres. Following that, we compared the average yields per acre for

series I, II, III and IV to those taken from probate inventories and farm

accounts. We analysed the deviations to determine which series is closer to

current site-specific knowledge. We then performed the opposite procedure to

determine what the average surface area should be in order for each of the

series to better fit the available yield database we have.

Next, we compared the four series with all of the output estimates available,

both net and gross, and with demand figures to again observe which has a lower

deviation. Finally, we applied a Cobb-Douglas regression model to the period

1640 to 1761 for the four logarithmical demand series through the non-linear

equation Dwheat= P∝wheat Iβ, where Dwheat stands for the national annual wheat demand in bushels, P∝wheat stands for annual wheat prices, I is the annual English GDP as a measure of national income (Broadberry et al., 2015), ∝ stands for an approximation of price elasticity, and β represents income elasticity. In addition, we also calculated the price

elasticity of each of the four series by means of the method proposed by

Campbell and Ó Gráda (2011), that is, by differentiating the price and quantity series to

eliminate the trend and developing a simple regression model.

Accordingly, we chose the series with least deviation and tested whether the

short-term movements were coherent. To do this, we examined the historiography

and verified its correspondence with the movements of the series. Additionally,

we linked the chosen series with the first statistics available from 1884

onwards by gradually incorporating a growing income-effect from 1761 onwards

(obtaining a new series of net national production, series V) and then adding

the net external balance (obtaining a new demand series, series VI). The aim of

making this connection was to verify whether the series fits the current

long-term historiographical perspective, acknowledging that the price

elasticity implicit in Davenant’s Law put forward in 1699 gradually lost accuracy and relevance with economic

growth in the long run. As Campbell and Ó Gráda (2011) demonstrated, during the process of change from subsistence farming to

a market economy prices were increasingly conditioned by international trade

and other factors.

4. DISCUSSION

The four English gross-production series of wheat from 1640 to 1761 (I, II, III

and IV) are presented in Graphs 1 and 2. They show a range between the most

optimistic (II) and the most pessimistic (III) series. To determine which comes

closest to existing evidence, we compared them with the database provided by

probate inventories and farm accounts (Tables 2 to 6).

Graphs 1 and 2

English gross production of wheat in millions of bushels, 1640-1761

Sources: our own calculation, from the following sources and methods. Series I

(gross_only_pop_broad) is obtained with 27.94 million net bushels provided by

Broadberry et al. (2015) c. 1700, applying Davenant’s Law with Clark (2004, 2005, 2007) prices, and adding population (Wrigley & Schofield, 1981), as well as 2.5 bu/acre of seeds and other uses. Series II

(gross_pop_rent_broad) also adds income variation (based on British GDP by

Broadberry et al., 2015) corrected with the average value 0.4, adding 2.5 bu/acre of seeds and

other uses. Series III (gross_only_pop_deane) takes the gross datum provided by

Deane and Cole (1967) for 1700 as a starting point, applying Davenant’s Law and adding population. Series IV (gross_pop_rent_deane) adds the income

evolution corrected with 0.4 to series III.

According to these results, between 1640 and 1761 average wheat yields were 18.1

bu/acre. The first thing we observe is that the four series correlate well with

this baseline and that their implicit yields range from 15.9 to 19.9 bu/acre.

Series I and IV present a lower deviation (-4.5% and +3.4%). If we adjust the

surface area of land cultivated with wheat for each series to the yields

obtained on the farms, we also observe that I and IV have the best fit to the

available estimates, and especially series I with a deviation of only 1%. The

feeling that series I is the best fit is confirmed by comparing the total

outputs estimated by other authors, where the deviation is only 4%.

Table 2

Comparison with English wheat series estimated from probate inventories

and farm accounts, 1640-1761

| SERIES | Estimated yield | Deviation | Correlation |

| BROAD_POP (I) | 17.3 bu/acre | -4.5% | 0.66 |

| BROAD_POP_RENT (II) | 19.9 bu/acre | 10.2% | 0.75 |

| DEANE_POP (III) | 15.9 bu/acre | -12.3% | 0.65 |

| DEANE_POP_RENT (IV) | 18.7 bu/acre | 3.4% | 0.74 |

Source: our own calculation. Between 1640 and 1761 average wheat yields from

probate inventories and farm accounts were 18.1 bu/acre.

Table 3

English Land surface cultivated with wheat (millions of acres) necessary to fit

the yields of the four estimated series to those obtained from probate

inventories and farm accounts, 1640-1761

SERIES Cultivated area required, in millions of acres Deviation

| SERIES | Cultivated area required, in millions of acres | Deviation |

| BROAD_POP (I) | 2.01 | 1% |

| BROAD_POP_RENT (II) | 2.27 | 14% |

| DEANE_POP (III) | 1.85 | -7% |

| DEANE_POP_RENT (IV) | 2.12 | 6% |

Source: our own calculation. Average surface stated by Broadberry et al. (2015) between 1650 and 1750 = 2 million acres.

Table 4

Comparison of our English series of wheat production with outputs estimated by

other authors, 1645-1761

| SERIES | Average estimated output | Deviation | Correlation coefficient |

| BROAD_POP (I) | 32.1 | 4.0% | 0.80 |

| BROAD_POP_RENT (II) | 37.5 | 21.6% | 0.89 |

| DEANE_POP (III) | 29.3 | -5.1% | 0.82 |

| DEANE_POP_RENT (IV) | 35.0 | 13.6% | 0.89 |

Source: our own calculation from the sources and methods explained in Table 1.

The conclusion is simple. Series I, that is, the one calculated from physical

estimates originating in Broadberry et al. (2015) with Davenant’s price elasticity and the population trend (using 1700 as a year of average

harvest throughout the period) is the one with the best fit. This is based on

two main facts. The first is that the wheat component of the agricultural GDP

estimated by Broadberry et al. (2015) seems very reliable. The second is about the elasticities. The price

elasticities of the different demand curves are -0.39/-0.38 in I, -0.33/-0.39

in II, -0.47/-0.46 in III, and -0.40/-0.47 in IV (Tables 5 and 6). On the other

hand, income elasticity is nearly zero in I and III, and 0.6/0.7 in II and IV.

Table 5

Price and income elasticities of English wheat consumption

calculated through the Cobb-Douglas method, 1645-1761

| SERIES | Price elasticity | Income elasticity |

| BROAD_POP (I) | -0.39 | 0 |

| BROAD_POP_RENT (II) | -0.33 | 0.59 |

| DEANE_POP (III) | -0.47 | 0 |

| DEANE_POP_RENT (IV) | -0.40 | 0.68 |

Source: our own calculation. Cobb-Douglas method has been applied.

Table 6

Price elasticity of English wheat consumption

obtained through differences and logarithms, 1645-1761

| SERIES | Price elasticity |

| BROAD_POP (I) | -0.38 |

| BROAD_POP_RENT (II) | -0.39 |

| DEANE_POP (III) | -0.46 |

| DEANE_POP_RENT (IV) | -0.47 |

Source: our own calculation. Price and production series differentiation method

has been applied.

If series I is the closest to the estimates obtained from farm accounts and

probate inventories, it means that Davenant’s equation and its elasticity are not mere idle speculation. The equation fits

with Campbell and Ó Gráda’s (2011) estimates, since it is halfway along the decreasing trend of harvest

variability from the Middle Ages to the 19th century. Income elasticity has little significance between 1645 and 1761,

proving this to be an age when rent was not a relevant component of consumption

decisions. If we tried instead a 0.5 to 0.7 income elasticity of wheat

consumption, as has sometimes been claimed, we would move away from the

estimates obtained from a large set of farm accounts and probate inventories

accumulated during the last forty years. In fact, this would involve an

unreliable national wheat yield of 31.2 bu/acre (according to our series II),

much higher than the 22.4 provided by Michael Turner et al. (2001) for the years 1750-59, the 20 provided by Robert Allen (2005) for 1750,

and the 20.1 by Jonathan Theobald (2002) also for 1750. The only way to

consider income a significant demand factor throughout the period from 1640 to

1761 in a way that might fit the available estimates, and our own results,

would be to assume a higher average of wheat cultivated area of around 10%, or

the part allocated to seeds and other uses being 50% lower than the ones

considered here –something that would require significant advances in empirical studies based on

local sources to allow a profound change in current assumptions.

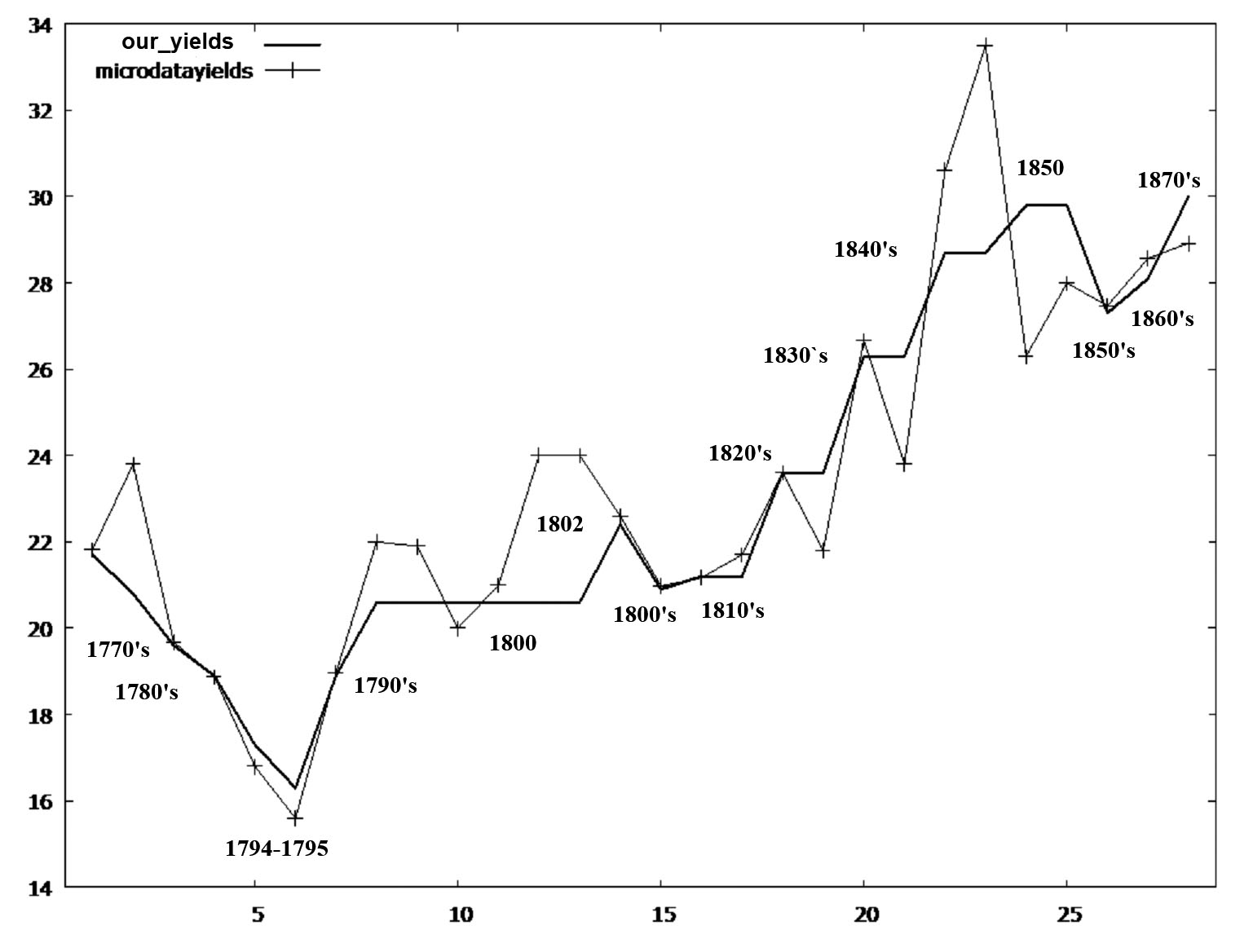

GRAPH 3

Gross yields in bu/acre of our series V of English wheat production,

compared to those resulting from other site-specific sources indicated

in the previous tables, 1760-1870

Source: our own calculation.

The above does not preclude the existence of a structural change during the

second half of the 18th century, through which income elasticity would have gained momentum along with

the growing income per capita. If we try to incorporate this ascending effect

in series I, lengthening it until 1850 with an average income elasticity of 0.6

(that is, close to 0 until the mid-18th century and growing to 1 in the 19th century), we see how the evolution of the wheat output, demand and yields

obtained fit the trends observed by economic historians so far (series V and

VI, Graphs 3 and 5, Table 7). The correlation coefficient between our gross

yield estimations of wheat per acre and those observed in the main sources is

90%, and average deviation between them is only 1%. These results have been

obtained through a logarithmic regression model of the series between 1640 and

1870: we obtain a non-linear equation of Dwheat = P-0,65wheat P0,8agric I0,6, where Dwheat stands for the national demand of wheat in bushels, Pwheat stands for wheat prices, Pagric is the centennial index of agricultural prices and I stands for the British centennial GDP (Broadberry et al., 2015). The addition of the three elasticities is not equal to zero, since we

are not in perfect competition.

However, the accuracy of these results depends to a high degree on two

variables: the wheat cultivated area and the difference between the gross and

net outputs; that is, the resulting quantity after deducting the part allocated

to seeds, personal consumption, payments in kind, animal feeding or losses.

This stands true for the whole period analysed here. The number of acres of

land used in wheat cultivation is unknown, but there is evidence that

demographic pressure, together with prices and income changes, strongly

affected its evolution in the long term. All published researches assume that

from the second half of the 17th century on, the wheat cultivated area grew steadily until soon after the massive

introduction of the American grain imports during the 1870s and 1880s. Robert

Allen (2005) provided the estimates of 1.4 million of acres in 1700, 2.1 in

1750, 2.5 in 1800, and 3.6 in 1850. The statistical series of wheat cropland

surface began in 1867 with 3.37 million acres.

Regarding the difference between net and gross yields per acre, what we can say

on the whole is that this difference must have been between 2 and 2.5. Peter J.

Bowden (1985) provided some site-specific estimates on wheat harvest detraction

of seeds for sowing and animal feeding ranging from 2.25 to 3.37 bushels/acre

between 1670 and 1745. Mark Overton (1984) quoted Bennet (2-2.5 bu/acre) and

King (who estimated a range of seed-yield ratios from 1:4 to 1:8). Anthony

Wrigley (1987) suggested a reference value of 2.5 (quoting Bowden and Slicher

van Bath), plus 1 in other cereals for cattle-feeding. In some passages in

their writings on agriculture, Robert Plot and John Mortimer claimed that

farmers sowed between 2 and 2.5 bu/acre of wheat, or 2 bu/acre in poor soils

and 3 in the most productive, respectively (Plot, 1705: 250; Mortimer, 1712:

95). All of these estimates exclude personal consumption, payments in kind or

simply losses within farms.

Our series can also be compared with the crop estimates provided by English

agricultural historiography. William G. Hoskins (1968: 20-2) described as

deficient those crops from the years 1646, 1657, 1710, and 1711; as bad or very

bad crops those from the years 1647, 1648, 1649, 1658, 1661, 1662, 1673, 1674,

1678, 1692, 1693, 1695, 1696, 1697, 1698, 1708, 1709, 1714, 1727, 1728, and

1729; as “average” crops those from the years 1699, 1700, 1718, 1719, and 1720; and as good crop

years those from 1652, 1653, 1654, 1655, 1665-72, together with the 1680s,

generally good, as well as the periods 1700-07 and 1721-23. Peter Bowden (1985:

56) suggested the existence of bad crops in the second half of the 17th century in the periods 1645-51, 1656-63, 1695-99 and good crops in the periods

1664-72, 1685-91, 1714-24, and 1741-49. Our series fits the period 1640-1750

quite well (Table 8).

GRAPH 4

Long-term evolution of English wheat yields in bu/acre, from 1645 to 1850

Source: our own calculation.

GRAPH 5

Long-term comparison of our estimates of English wheat output and demand in

millions of bushels (series V and VI)

Source: our own calculation.

Table 7

Comparison of different estimates of English wheat yields, 1760-1879

| Years | Our estimates (gross, bu/acre) | Other authors (gross, bu/acre) | Deviation | Authors |

| 1760-69 | 21.7 | 21.82 | 0.5% | Turner et al. (2001) |

| 1770 | 20.8 | 23.80 | 12.6% | Artur Young (John, 1986) |

| 1770-79 | 19.6 | 19.68 | 0.4% | Turner et al. (2001) |

| 1780-89 | 18.9 | 18.88 | -0.1% | Turner et al. (2001) |

| 1794 | 17.3 | 16.8 | -3.0% | Harvest inquiry (John, 1986) |

| 1795 | 16.3 | 15.6 | -4.5% | Harvest inquiry (John, 1986) |

| 1790-99 | 18.9 | 18.97 | 0.4% | Turner et al. (2001) |

| 1800 | 20.6 | 22 | 6.4% | Oxon (Allen, 2005) |

| 1800 | 20.6 | 21.9 | 5.9% | Harvest inquiry (John, 1986) |

| 1800 | 20.6 | 20 | -3.0% | England (Allen, 2005) |

| 1800 | 20.6 | 21 | 1.9% | Hants (Glennie, 1991) |

| 1800 | 20.6 | 24 | 14.2% | Herts (Glennie, 1991) |

| 1800 | 20.6 | 24 | 14.2% | Holderness (1989) |

| 1802 | 22.4 | 22.6 | 0.9% | Crop Ret. (Turner et al., 2001) |

| 1800-09 | 20.9 | 20.98 | 0.4% | Turner et al. (2001) |

| 1810-19 | 21.2 | 21.17 | -0.1% | Turner et al. (2001) |

| 1810-19 | 21.2 | 21.7 | 2.3% | Healy and Jones (1962) |

| 1820-29 | 23.6 | 23.6 | 0.0% | Turner et al. (2001) |

| 1820-29 | 23.6 | 21.8 | -8.3% | Healy and Jones (1962) |

| 1830-39 | 26.3 | 26.67 | 1.4% | Turner et al. (2001) |

| 1830-39 | 26.3 | 23.8 | -10.5% | Healy and Jones (1962) |

| 1840-49 | 28.7 | 30.6 | 6.2% |

Turner et al. (2001) |

| 1840-49 | 28.7 | 33.5 | 14.3% | Healy and Jones (1962) |

| 1850 | 29.8 | 26.3 | -13.3% | Craigie (1883; from Turner et al., 2001) |

| 1850 | 29.8 | 28 | -6.4% | Allen (2005) |

| 1850-59 | 27.3 | 27.47 | 0.6% |

Turner et al. (2001) |

| 1860-69 | 28.1 | 28.57 | 1.6% | Turner et al. (2001) |

| 1870-79 | 30 | 28.92 | -3.7% | Turner et al. (2001) |

| Mean | 23.03 | 23.36 | 1.1% | |

| Median | 21.2 | 22.3 | 0.5% | |

| Minimum | 16.3 | 15.6 | -13.3% | |

| Maximum | 30 | 33.5 | 14.3% | |

| Standard deviation | 4.07 | 4.160 | 0.07 | |

| C.V. | 0.177 | 0.178 | 6.23 | |

Source: our own calculation. The correlation coefficient between the two columns is 0.9.

Table 8

Comparison of the variation of our English series of gross wheat output

with the available chronology of the character of harvests, 1645-1749

| Hoskins | Years | Wheat gross output (bushels) |

| Deficient crops | 1646, 1657, 1710, 1711 | 31,306,518 (-8.8%) |

| Bad and very bad crops | 1647, 1648, 1649, 1658, 1661, 1662, | |

| 1673, 1674, 1678, 1692, 1693, 1695, | 30,330,181 (-11.6%) |

| 1696, 1697, 1698, 1708, 1709, 1714, |

| 1727, 1728, 1729 | |

| Average crops | 1699, 1700, 1718, 1719, 1720 | 34,302,075 |

| Good years | 1652, 1653, 1654, 1655, 1665-72, |

| 1680s generally good, 1700-07 | 35,332,446 (+3%) |

| and 1721-23 | |

| Bowden | Years | Wheat gross output (bushels) |

| Bad crops | 1645-51 | 29,696,256 |

| 1656-63 | 30,491,192 |

| 1695-99 | 29,886,137 |

| Good crops | 1664-72 | 34,251,154 |

| 1685-91 | 35,718,380 | |

| 1714-24 | 34,976,126 |

| 1741-49 | 37,842,623 | |

Source: our own calculation.

This verification can be completed by comparing Table 8 with the sequence of

food riots studied by John Bohstedt (2010), a clear coincidence being observed

with the worst production years. Furthermore, our annual series of wheat

production also allows us to clear up some discrepancies. For example, Hoskins

claimed that 1699 was an average year, whereas Bowden considered it bad. Who

was right? Our results are 29.7 million bushels, a low figure. Therefore, it

would appear that Bowden was closer to reality.

5. CONCLUSIONS

This article presents the first estimation of the English annual series of wheat

production, yields (considering acreage) and demand (adding foreign net trade

balance) for a period for which these data are unknown: 1645-1761. The

methodology applied is based on the price elasticity in England calculated by

Charles Davenant in 1699, anchoring the series on the “usual” average harvest of 1700 and setting a long-term trend based on population and

income growth in a way that allows supply and demand to be integrated by

considering a slow increase in income elasticity from 1750 onwards. The results

match the available estimates on yields and harvests gathered from

site-specific farm accounts and probate inventories from that period, and also

indicate that the starting points used by Broadberry et al. (2015) to build up the agricultural GDP in 1700 are reliable, at least in the

case of wheat.

Through this exercise, Davenant’s Law has been revealed to be much more accurate than just guesswork, probably

because it was based on well-grounded empirical knowledge of British traders at

the time. The series generated fits well with the independent sources available

and confirms both the decreasing trend of price elasticity in the very long

term (Campbell & Ó Gráda, 2011) and historiography on the variability of wheat crops (Hoskins, 1968;

Bowden, 1985; Bohstedt, 2010).

The estimates carried out in the article suggest that income elasticity had

little significant effect on consumption decisions, at least until the mid-18th century, increasing in importance at a later date. If we lengthen the series to

the year when official statistics began in 1884, assuming an income elasticity

of 0.6 for the whole period 1645-1884, the trend fits the available estimates

on yields and output. The series confirms that wheat production and yields

evolved negatively during the second half of the 18th century, and took off dramatically in the 19th century. Accordingly, seen from a production and yields perspective, the

Agricultural Revolution seems to have taken place in two very different

periods, before 1750 and after 1800.

However, many questions remain open. The change in surface area cultivated with

wheat must be better studied. It is necessary to consider possible changes in

the percentage allocated to seeds in more detail, as well as their uses other

than market sale. The new estimates should also be extended to other cereals

until 1884. The reasons behind the structural breakpoint found around 1761 must

also be found, when wheat yields started to fall, total wheat production slowed

down, England became a net importer, prices rocketed, and physical wheat

consumption per head fell, despite bread intake remaining more stable thanks to

substitution among grains.

Acknowledgments

The authors thank to the participants in the first seminars where this article

was presented as early working paper: “Old and New Worlds: The Global Challenges of Rural History”, ISCTEIUL (University Institute of Lisbon, January 2016), and the PhD Seminar

on Economic History at the University of Barcelona (February 2016). Also,

authors thank to the anonymous reviewer of Historia Agraria for his contributions to improve this article. This work has been funded by the

Spanish projects HAR2014-54891-P and HAR2015-69620-C2-1-P, and the

international Partnership Grant SSHRC 895-2011-1020 on “Sustainable Farm Systems: Long-Term Socio-ecological Metabolism in Western

Agriculture” funded by the Social Sciences and Humanities Research Council of Canada.

REFERENCES

Abler, D. (2010). Demand Growth in Developing Countries. OECD Food, Agriculture and Fisheries Papers, (29).

Allen, R. C. (1988). The Growth of Labor Productivity in Early Modern English Agriculture. Explorations in Economic History, 25 (2), 117-46.

Allen, R. C. (1989). Enclosure, Farming Methods and the Growth of Productivity in the South

Midlands. In G. Grantham & C. S. Leonard (Eds.), Agrarian Organization in the Century of Industrialization: Europe, Russia, and

North America (pp. 69-88). Greenwich: Jai Pr. (Research in Economic History, suppl. 5).

Allen, R. C. (1991). The Two English Agricultural Revolutions, 1450-1850. In B. S. M. Campbell & M. Overton (Eds.), Land, Labour and Livestock: Historical Studies in European Agricultural

Productivity (pp. 236-54). Manchester: Manchester University Press.

Allen, R. C. (1999). Tracking the Agricultural Revolution in England. Economic History Review, (52), 209-35.

Allen, R. C. (2005). English and Welsh Agriculture, 1300-1850: Outputs, Inputs and Income. Oxford University Working Papers.

Allen, R. C. (2007). Pessimism Preserved: Real Wages in the British Industrial Revolution. Oxford University Working Papers.

Allen, R. C. (2008). The Nitrogen Hypothesis and the English Agricultural Revolution: A

Biological Analysis. The Journal of Economic History, 68 (1), 182-210.

Allen, R. C. (2009). The British Industrial Revolution in Global Perspective. Cambridge: Cambridge University Press.

Appleby, A. B. (1979). Grain Prices and Subsistence Crises in England and France, 1590-1740. The Journal of Economic History, 39, (4), 865-87.

Barquín, R. (2005). The Elasticity of Demand for Wheat in the 14th to 18th Centuries. Revista de Historia Económica-Journal of Iberian and Latin American Economic History, 23 (2), 241-68.

Bohstedt, J. (2010). The Politics of Provisions: Food Riots, Moral Economy and Market Transition in

England, 1550-1850. Farnham: Ashgate.

Bowden, P. (1985). Agricultural Prices, Wages, Farm Profits, and Rents. In J. Thirsk (Ed.), The Agrarian History of England and Wales. 5: 1640-1750. Part 2: Agrarian Change (pp. 1-117). Cambridge: Cambridge University Press.

Broadberry, S., Campbell, B. M. S., Klein, A., Overton, M. & Van Leeuwen, B. (2015). British Economic Growth, 1270-1870. Cambridge: Cambridge University Press.

Brunt, L. (2004). Nature or Nurture? Explaining English Wheat Yields in the Industrial

Revolution, c. 1770. The Journal of Economic History, 64 (1), 193-225.

Brunt, L. (2015). Weather Shocks and English Wheat Yields, 1690-1871. Explorations in Economic History, (57), 50-58.

Caird, J. (1852). English Agriculture. London: Cassell.

Campbell, B. M. S. & Ó Gráda, C. (2011). Harvest Shortfalls, Grain Prices, and Famines in Preindustrial England.

The Journal of Economic History, 71 (4), 859-86.

Chartres, J. A. (1985). The Marketing of Agricultural Produce. In J. Thirsk (Ed.), The Agrarian History of England and Wales. 5: 1640-1750. Part 2: Agrarian Change (pp. 406-502). Cambridge: Cambridge University Press.

Chartres, J. A. (1995). Market Integration and Agricultural Output in Seventeenth-, Eighteenth-,

and early Nineteenth-Century England. The Agricultural History Review, 43 (2), 117-38.

Clark, G. (2002). The Agricultural Revolution and the Industrial Revolution: England,

1500-1912. University of California Working Paper.

Clark, G. (2004). The Price History of English Agriculture, 1209-1914. Research in Economic History, (22), 41-124.

Clark, G. (2005). The Condition of the Working-Class in England, 1209-2004. Journal of Political Economy, 113 (6), 1307-40.

Clark, G. (2007). The Long March of History: Farm Wages, Population and Economic Growth,

England 1209-1869. Economic History Review, 60 (1), 97-135.

Clark, G., Cummings, J. & Smith, B. (2010). The Surprising Wealth of Pre-industrial England. SSRN Working Paper.

Collins, E. J. T. (1975). Dietary Change and Cereal Consumption in Britain in the Nineteenth

Century. The Agricultural History Review, 23 (2), 97-115.

Comber, W. T. (1808). An Inquiry into the State of National Subsistence as connected with the Progress

of Wealth and Population. London: T. Cadell & W. Davis.

Crafts, N. F. R. (1980). Income Elasticities of Demand and the Release of Labor by Agriculture

during the British Industrial Revolution: A Further Appraisal. Journal of European Economic History, (9), 153-68.

Davenant, C. (1771[1699]). An Essay upon the Probable Methods of Making a People Gainers in

the Balance of Trade. In C. Whitworth (Ed.), The Political and Commercial Works of Charles Davenant. London: R. Horsfield.

Davies, D. (1795). The Case of Labourers in Husbandry. London: C. G. & J. Robinson.

Deane, P. & Cole, W. A. (1967). British Economic Growth, 1688-1959, Trends and Structure. 2nd ed. Cambridge: Cambridge University Press.

Eden, F. M. (1797). The State of the Poor. London: Cass.

Endres, A. M. (1987). The King-Davenant “Law” in Classical Economics. History of Political Economy, 19 (4), 621-38.

Fogel, R. W. (2004). The Escape from Hunger and Premature Death, 1700-2100: Europe, America, and the

Third World. Cambridge: Cambridge University Press.

Glennie, P. (1991). Measuring Crop Yields in Early Modern England. In B. M. S. Campbell & M. Overton (Eds.), Land, Labour and Livestock: Historical Studies in European Agricultural

Productivity (pp. 255-83). Manchester: Manchester University Press.

Healy, M. J. R. & Jones, E. L. (1962). Wheat Yields in England, 1815-59. Journal of the Royal Statistical Society. Series A (General), 125 (4), 574-79.

Hipkin, S. (2012). The Coastal Metropolitan Corn Trade in Later Seventeenth Century

England. The Economic History Review, 65 (1), 220-55.

Holderness, B. A. (1989). Prices, Productivity, and Output. In G. E. Mingay (Ed.), The Agrarian History of England and Wales. 6: 1750-1850 (pp. 1-118). Cambridge: Cambridge University Press.

Hoskins, W. G. (1968). Harvest Fluctuations and English Economic History, 1620-1759. The Agricultural History Review, 16 (1), 15-31.

Hoyle, R. W. (2013). Why was there no Crisis in England in the 1690’s? In R. W. Hoyle (Ed.), The Farmer in England, 1650-1980 (pp. 69-100). London: Routledge.

Hutchison, T. W. (1988). Before Adam Smith: The Emergence of Political Economy, 1662-1776. Oxford: Blackwell.

John, A. H. (1986). Statistical Appendix. In G. E. Mingay (Ed.), The Agrarian History of England and Wales. 6: 1750-1850 (pp. 972-1155). Cambridge: Cambridge University Press.

Jones, E. L. (1965). Agriculture and Economic Growth in England, 1660-1750: Agricultural

Change. The Journal of Economic History, 25 (1), 1-18.

Kain, R. J. P. & Prince, H. C. (2006). The Tithe Surveys of England and Wales. Cambridge: Cambridge University Press.

Kelly, M. & Ó Gráda, C. (2013). Numerare Est Errare: Agricultural Output and Food Supply in England Before and During the

Industrial Revolution. The Journal of Economic History, 73 (4), 1132-163.

Kerridge, E. (1967). The Agrarian Revolution. London: George Allen & Unwin.

Lawes, J. B. & Gilbert, J. H. (1893). Home produce, Imports, Consumption and Price of Wheat over 40 Harvest-Years,

1852-3 to 1891-2. London: Spottiswoode.

Mitchell, B. R. (1988). British Historical Statistics. Cambridge: Cambridge University Press.

Mortimer, J. (1712). The Whole Art of Husbandry: Or, the Way of Managing and Improving of Land.

Being a Full Collection of what Hath Been Writ, Either by Ancient Or Modern

Authors:... As Also an Account of the Particular Sorts of Husbandry Used in

Several Counties;... To which is Added, the Country-man’s Kalendar. London: R. Robinson.

Neild, W. (1841). Comparative Statement of the Income and Expenditure of Certain Families

of the Working Classes in Manchester and Duckenfield, in the Years 1836 and

1841. Journal of the Statistical Society of London, 4 (4), 320-34.

Nielsen, M., Smit, J. & Guillén, J. (2012). Price Effects of Changing Quantities Supplied at the Integrated European

Fish Market. Marine Resource Economics, 27 (2), 165-80.

Ormrod. D. (1985). English Grain Exports and the Structure of Agrarian Capitalism, 1700-1760. Hull: Hull University Press.

Overton, M. (1979). Estimating Crop Yields from Probate Inventories: An Example from East

Anglia, 1585-1735. The Journal of Economic History, 39 (2), 363-78.

Overton, M. (1984). Agricultural Productivity in Eighteenth-Century England: Some Further

Speculations. The Economic History Review, 37 (2), 252-57.

Overton, M. (1991). The Determinants of Crop Yields in Early Modern England. In B. M. S. Campbell & M. Overton (Eds.), Land, Labour and Livestock: Historical Studies in European Agricultural

Productivity. Manchester: Manchester University Press.

Overton, M. (1996a). Re-Establishing the English Agricultural Revolution. The Agricultural History Review, 44 (1), 1-20.

Overton, M. (1996b). Agricultural Revolution in England: The Transformation of the Agrarian Economy,

1500-1850. Cambridge: Cambridge University Press.

Parenti, G. (1942). Prezzi e mercato del grano a Siena, 1546-1765. Firenze: C. Cya.

Persson, K. G. (1999). Grain Markets in Europe, 1500-1900: Integration and Deregulation. Cambridge: Cambridge University Press.

Petersen, C. (1995). Bread and the British Economy, c 1770-1870. Aldershot: Scholar Press.

Petty, W. (1927 [1687]). The Petty Papers: Some Unpublished Writings of Sir William Petty. London: Constable.

Plot, R. (1705 [1676]). The Natural History of Oxford-Shire, Being an Essay towards the Natural History

of England. London: Leon Lischfield, for Charles Brome and J. Nicholson.

Rogers, J. E. T. (1877). A History of Agriculture and Prices in England. 6: 1583-1702. Oxford: Clarendon.

Simonin, J. P. (1996). Des premiers énoncés de la loi de King à sa remise en cause: Essais de mesures ou fictions théoriques. Histoire & Mesure, 11 (3-4), 213-54.

Slicher van Bath, B. H. (1963). The Agrarian History of Western Europe: A. D. 500-1850. London: Edward Arnold.

Tello, E., Martínez, J. L., Jover, G., Olarieta, J. R., García Ruiz, R., González de Molina, M., Badia, M., Winiwarter, V. & Koepke, N. (2017). The Onset of the English Agricultural Revolution: Climate Factors and

Soil Nutrients. The Journal of Interdisciplinary History, 47 (4), 445-74.

Theobald, J. (2002). Agricultural Productivity in Woodland High Suffolk, 1600-1850. The Agricultural History Review, 50 (1), 1-24.

Tooke, T. & Newmarch, W. (1838). A History of Prices, and of the State of the Circulation, from 1793 to 1837. London: Longman, Orme, Brown, Green, and Longmans.

Turner, M. (1982). Agricultural Productivity in England in the Eighteenth Century: Evidence

from Crop Yields. The Economic History Review, 35 (4), 489-510.

Turner, M. (1986). English Open Fields and Enclosures: Retardation or Productivity

Improvements. The Journal of Economic History, 46 (3), 669-92.

Turner, M. E., Becket, J. V. & Afton, B. (1997). Agricultural Rent in England, 1690-1914. Cambridge: Cambridge University Press.

Turner, M. E., Becket, J. V. & Afton, B. (2001). Farm Production in England, 1700-1914. Oxford: Oxford University Press.

Uebele, M., Grünebaum, T. & Kopsidis, M. (2013). King’s Law and Food Storage in Saxony, c. 1790-1830. Center for Quantitative Economics Working Papers, (26).

Wrigley, E. A. (1987). People, Cities and Wealth. Oxford: Blackwell.

Wrigley, E. A. & Schofield, R. S. (1981). The Population History of England, 1541-1871: A Reconstruction. Cambridge: Cambridge University Press.

Yelling, J. A. (1970). Probate Inventories and the Geography of Livestock Farming: A Study of

East Worcestershire, 1540-1750. Transactions of the Institute of British Geographers, (51), 111-26.

Yelling, J. A. (1973). Changes in Crop Production in East Worcestershire 1540-1867. Agricultural. History Review, 21 (1), 18-34.

APPENDIX

| WHEAT GROSS OUTPUT |

YEAR | (BROAD_POP, SERIES I) |

| Million bushels |

| 1640 | 34.5 |

| 1641 | 32.2 |

| 1642 | 33.5 |

| 1643 | 32.9 |

| 1644 | 33.5 |

| 1645 | 33.7 |

| 1646 | 32.3 |

| 1647 | 28.8 |

| 1648 | 27.3 |

| 1649 | 28.1 |

| 1650 | 28.5 |

| 1651 | 29.3 |

| 1652 | 31.6 |

| 1653 | 35.3 |

| 1654 | 38.9 |

| 1655 | 39.6 |

| 1656 | 33.6 |

| 1657 | 32.8 |

| 1658 | 30.0 |

| 1659 | 29.3 |

| 1660 | 30.2 |

| 1661 | 28.9 |

| 1662 | 27.9 |

| 1663 | 31.1 |

| 1664 | 31.6 |

| 1665 | 33.2 |

| 1666 | 36.1 |

| 1667 | 36.9 |

| 1668 | 36.2 |

| 1669 | 32.6 |

| 1670 | 33.9 |

| 1671 | 33.5 |

| 1672 | 34.3 |

| 1673 | 33.3 |

| 1674 | 29.2 |

| 1675 | 30.5 |

| 1676 | 35.5 |

| 1677 | 34.6 |

| 1678 | 31.6 |

| 1679 | 31.0 |

| 1680 | 33.6 |

| 1681 | 32.3 |

| 1682 | 32.7 |

| 1683 | 33.1 |

| 1684 | 32.6 |

| 1685 | 32.2 |

| 1686 | 35.3 |

| 1687 | 34.9 |

| 1688 | 37.2 |

| 1689 | 37.8 |

| 1690 | 35.9 |

| 1691 | 36.7 |

| 1692 | 32.1 |

| 1693 | 29.9 |

| 1694 | 30.1 |

| 1695 | 32.5 |

| 1696 | 30.3 |

| 1697 | 29.1 |

| 1698 | 28.0 |

| 1699 | 29.7 |

| 1700 | 32.9 |

| 1701 | 35.9 |

| 1702 | 38.1 |

| 1703 | 38.5 |

| 1704 | 34.9 |

| 1705 | 37.5 |

| 1706 | 38.6 |

| 1707 | 38.2 |

| 1708 | 34.5 |

| 1709 | 28.5 |

| 1710 | 28.1 |

| 1711 | 32.0 |

| 1712 | 33.8 |

| 1713 | 33.0 |

| 1714 | 31.1 |

| 1715 | 35.3 |

| 1716 | 33.2 |

| 1717 | 33.9 |

| 1718 | 35.7 |

| 1719 | 37.2 |

| 1720 | 34.6 |

| 1721 | 35.5 |

| 1722 | 36.4 |

| 1723 | 35.6 |

| 1724 | 36.2 |

| 1725 | 33.8 |

| 1726 | 32.5 |

| 1727 | 33.9 |

| 1728 | 30.3 |

| 1729 | 31.9 |

| 1730 | 35.7 |

| 1731 | 37.5 |

| 1732 | 40.8 |

| 1733 | 39.0 |

| 1734 | 36.0 |

| 1735 | 33.9 |

| 1736 | 34.5 |

| 1737 | 36.7 |

| 1738 | 37.6 |

| 1739 | 36.3 |

| 1740 | 32.3 |

| 1741 | 32.1 |

| 1742 | 37.9 |

| 1743 | 40.9 |

| 1744 | 41.6 |

| 1745 | 39.8 |

| 1746 | 36.7 |

| 1747 | 37.6 |

| 1748 | 36.8 |

| 1749 | 37.1 |

| 1750 | 37.5 |

| 1751 | 36.0 |

| 1752 | 34.5 |

| 1753 | 34.7 |

| 1754 | 36.8 |

| 1755 | 38.2 |

| 1756 | 35.2 |

| 1757 | 30.9 |

| 1758 | 33.6 |

| 1759 | 37.6 |

| 1760 | 39.0 |

| 1761 | 39.6 |